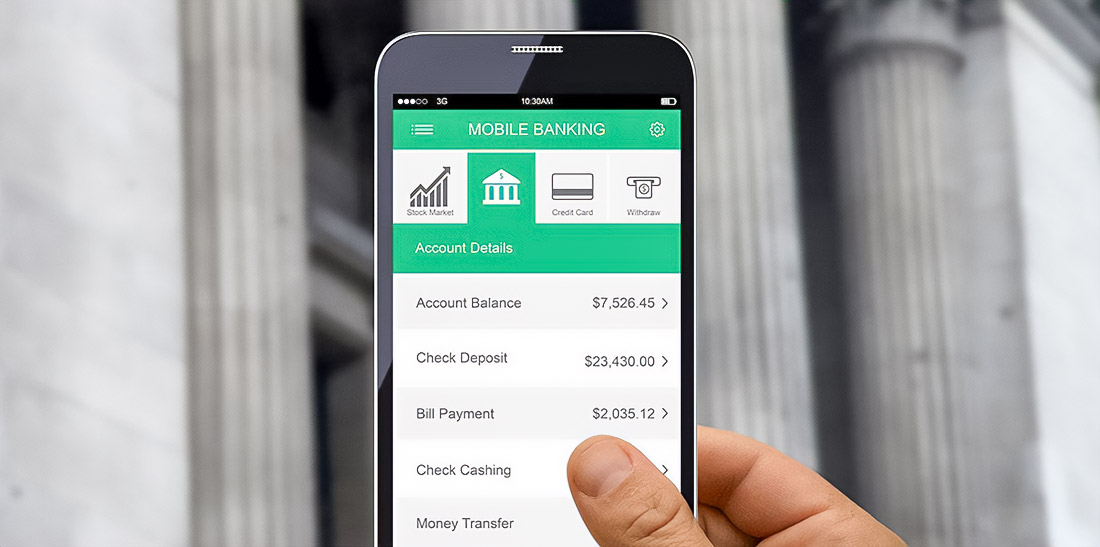

Mobile banking has long been more than just a way to check your balance. It enables users to pay bills, manage subscriptions, track expenses, and handle finances from anywhere. Leading platforms, like Mobile banking UAE, are used by around 90% of UAE residents, with over 85% engaging with mobile finance apps at least once a year, reflecting the growing reliance on digital banking solutions.

What Features Make Digital Bank Account UAE Convenient

- Payment automation: You can set up regular payments for rent, utilities, and subscriptions and don’t forget to pay them on time.

- Multi-currency in one application: managing accounts in AED, USD, EUR and GBP is convenient for travelers and migrants.

- Cost analytics: graphs by category, balance forecast, and limit notifications to avoid unexpected expenses.

- P2P and SWIFT transfers: instant and international transactions are carried out through the application.

These functions give you real control over money — no need to calculate manually or keep tables.

Why Mobile Banking UAE is Gaining Popularity

Convenience, speed and security are three key fields for the growth of mobile banking:

- Convenience: Now you can have at hand not only a card, but also tools for managing subscriptions, cost analysis, multi-currency and transfers.

- Speed: Operations are performed instantly, you save up to 30% of the time compared to a visit to the department.

- Safety: Banks are actively implementing biometrics, two-factor authentication and cryptographic protection — this meets the requirements of customers for confidentiality and protection of funds.

Indicators and Statistics

- More than 90% of UAE residents actively use mobile banking, which puts the country among the market leaders.

- From 2019 to 2022, the use of mobile banking increased by 65%.

- About 76% of customers prefer mobile banking because of its convenience and control.

The Best Digital Bank Account UAE In Terms of Functionality

- Liv by Emirates NBD: suitable for young people, offers cost analytics, targeted offers, multi-currency.

- Mashreq Neo: multilingualism, integration with investments, P2P transfers.

- Wio Bank: aimed at entrepreneurs and freelancers, includes e-commerce, virtual cards.

- YAP: instant transfers, no hidden fees, flexible terms.

- ADIB SmartBanking: Sharia accounts with cost control, voice control.

How Mobile Banking UAE Makes Life Easier

- Automatic notifications about increased expenses or minimum balance.

- Intuitive subscription management — cancel or change in two clicks.

- Multi-currency transfers without hidden fees, convenient when working with multiple countries.

- Fast switching between the accounts of AED, USD, EUR at the exchange rate.

Steps to Control Your Money

- Install the digital bank application (Liv, Neo, Wio, YAP, etc.).

- Register, upload your passport/ID, and complete a quick video verification.

- Open a UAE digital bank account and make a minimum deposit.

- Set up autopayments and enable cost analytics.

- Use fast transfers and monitor your balance 24/7.

Conclusion

Mobile banking UAE is not just a quick balance check. This includes daily monitoring, automation, multi-currency and security – all in one application. Now the UAE digital bank account UAE has become a full-fledged assistant for those who want to understand their expenses, manage subscriptions and be confident in their finances.

Basketball fan, mother of 2, fender owner, vintage furniture lover and HTML & CSS lover. Performing at the fulcrum of modernism and programing to give life to your brand. I sometimes make random things with friends.